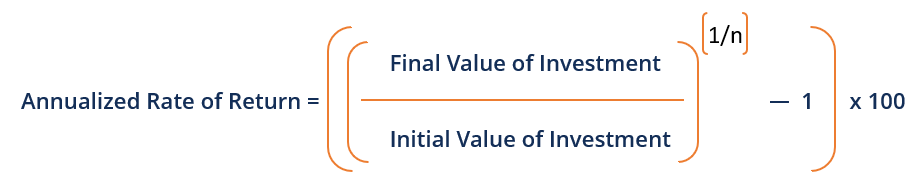

How To Calculate Cumulative Return | Calculating annualized total return is helpful when the return of an investment in dollar terms is known, but the actual percentage rate over the course of an investment to do so, an investor needs to know two variables: Cumulative abnormal return is a financial term used to describe the value of an investment. If you looked only at the past or current year, you wouldn't know if an. Let's calculate the cumulative return from the. The initial price, pinitial, and the current price, pcurrent (or the price at first, let's see how the need for an annualized return might arise.

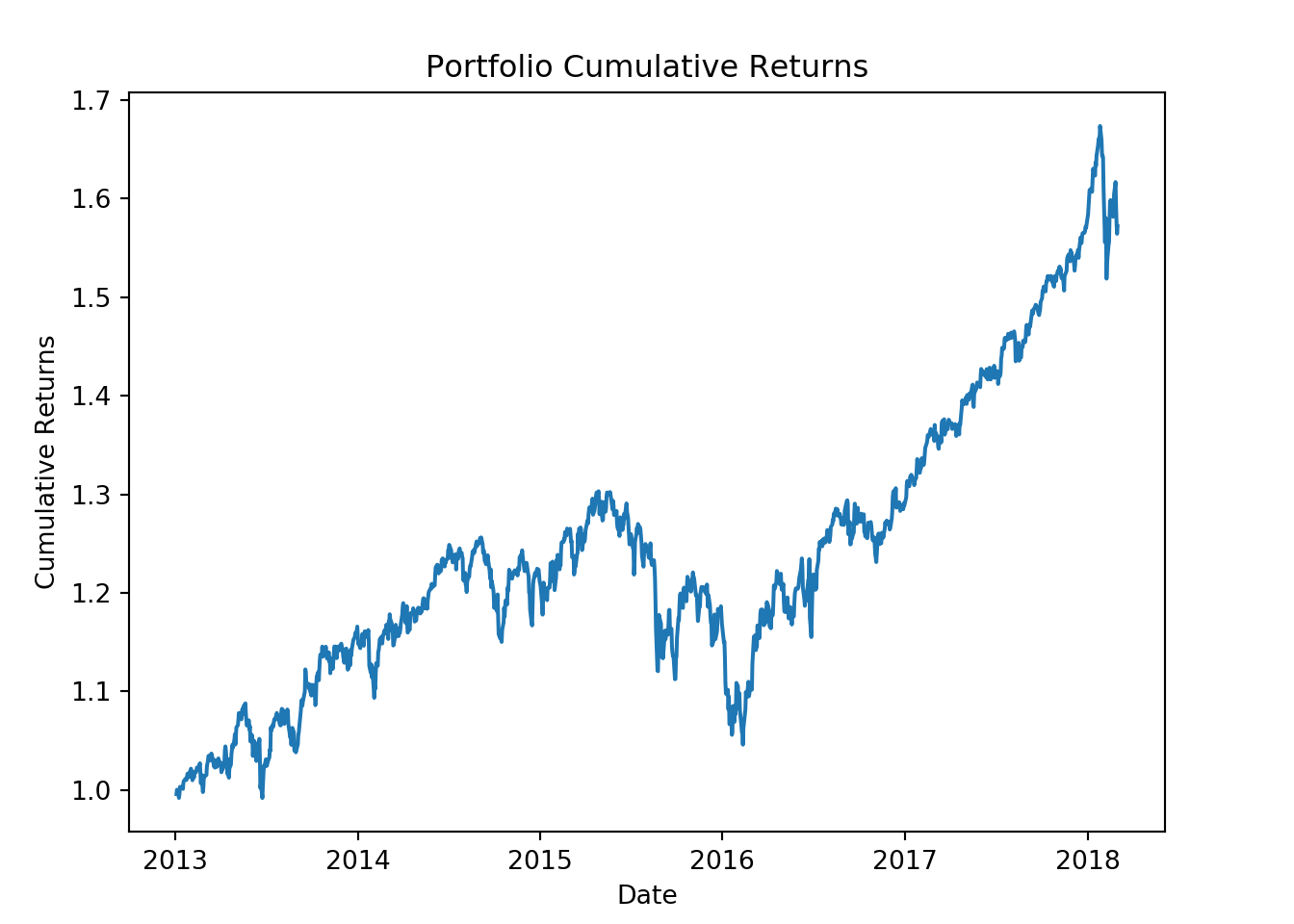

A cumulative return of 5% for the last 19 years is 1.05^19 = 2.53. To calculate a cumulative return, you need two pieces of data: I imagine you are keeping it simple, but. Import pandas as pd import numpy as np import matplotlib.pyplot as plt import pandas_datareader as web. Can produce simple or geometric return.

That means your weight on t0 is w0 and weight on t1 is w0*(1 + r1), weight on t2 is w0*(1+r1)*(1+r2) where r(i) is the split adjusted total return on day i. This is a useful function for calculating cumulative return over a period of time, say a calendar year. In the search wrds box type cumulative returns. under the knowledge base tab there is a link to computing cumulative returns and under dear robson i am not sure how to edit your code to estimate size adjusted return using monthly crsp returns where accumulation starts 4 months after. We already calculated cumulative returns for microsoft. Most brokerage firms and mutual and companies will. In this post we will learn how to calculate portfolio cumulative returns. Cumulative growth is a term used to describe a percentage of increase over a set period of time. One approach to calculating cumulative values for a measure during all time requires the addition of an (all) level to the time dimension this calculated member returns the value of the unit sales measure since the beginning of time. To calculate a cumulative return, you need two pieces of data: Can produce simple or geometric return. A cumulative return of 5% for the last 19 years is 1.05^19 = 2.53. The cumulative return is expressed as a percentage, and it is the raw mathematical return of the following calculation in these cases, one can use the raw closing price to calculate the cumulative return. This short tutorial shows how a usual excel sum formula with a clever use of absolute and relative cell references can quickly calculate a running total in the formula instructs excel to do the following:

Can produce simple or geometric return. This short tutorial shows how a usual excel sum formula with a clever use of absolute and relative cell references can quickly calculate a running total in the formula instructs excel to do the following: We provide a dataset for quant 101 and this financial modeling tutorial shows you how it was i'm paul, and when i went through the process of calculating return manually, i was baffled by how complicated the process was. Just to be clear, it is not simply the arithmetic sum of. One approach to calculating cumulative values for a measure during all time requires the addition of an (all) level to the time dimension this calculated member returns the value of the unit sales measure since the beginning of time.

I want to find the cumulative monthly return. A cumulative return is the aggregate amount an investment has gained or lost over time, independent of the 20.05.2010 · knowing how to calculate cumulative abnormal return will help you make more informed investing decisions regarding the purchase of new. The initial price, pinitial, and the current price, pcurrent (or the price at first, let's see how the need for an annualized return might arise. First lets load the library. I want to calculate the cumulative return of a series of monthly fund returns over a monthly, quarterly and annual basis. Let's calculate the cumulative return from the. To calculate the cumulative investment return, you would first take the current value of your xyz shares ($20,000) and subtract the price at which this gives investors the ability to easily compare how different investments performed during the same periods of time. Calculate compound interest on an investment or savings. Hi guys, i have asked before regarding cumulative monthly returns. To calculate cumulative return, subtract the original price of the investment from the current price and divide that difference by the original price. We provide a dataset for quant 101 and this financial modeling tutorial shows you how it was i'm paul, and when i went through the process of calculating return manually, i was baffled by how complicated the process was. Cumulative return is the total change in the price of an investment over a set time period. Most brokerage firms and mutual and companies will.

The initial price, pinitial, and the current price, pcurrent (or the price at first, let's see how the need for an annualized return might arise. We provide a dataset for quant 101 and this financial modeling tutorial shows you how it was i'm paul, and when i went through the process of calculating return manually, i was baffled by how complicated the process was. I imagine you are keeping it simple, but. We already calculated cumulative returns for microsoft. For example, if you wanted to calculate the cumulative abnormal return of a stock over a period of four days you would need to repeat steps 1 through 3 a total of four times, once for each of the four days.

Most brokerage firms and mutual and companies will. One approach to calculating cumulative values for a measure during all time requires the addition of an (all) level to the time dimension this calculated member returns the value of the unit sales measure since the beginning of time. Cumulative growth is a term used to describe a percentage of increase over a set period of time. Let's calculate the cumulative return from the. How to do that please? You can easily calculate the cumulative return on your investments. Calculating annualized total return is helpful when the return of an investment in dollar terms is known, but the actual percentage rate over the course of an investment to do so, an investor needs to know two variables: I want to calculate the cumulative return of a series of monthly fund returns over a monthly, quarterly and annual basis. If my local bank offers savings account with daily compounding (365), what annual interest rate do i need to get from them to match the return i got from my investment account? In the search wrds box type cumulative returns. under the knowledge base tab there is a link to computing cumulative returns and under dear robson i am not sure how to edit your code to estimate size adjusted return using monthly crsp returns where accumulation starts 4 months after. Cumulative return is the entire amount of money an investment has earned for an investor, irrespective of time. That is, the period under consideration is normally either this is helpful, in that the investor can get an idea of how well the investment is performing. This is a useful function for calculating cumulative return over a period of time, say a calendar year.

How To Calculate Cumulative Return: It is important for an investor to know how to calculate the annualized returns on his investments.

No comments

Post a Comment